For most of us living in the land of the SUV and the home of the pave, the automobile—including its purchase price, loan interest, fuel, maintenance, insurance, parking, tickets, tolls, taxes, depreciation, registration, etc.—will probably represent our greatest opportunity to save money on transportation. According to multiple sources, personal automobiles cost Americans an average of $1,000 per month, 95% of US households own them, and a whopping 85% of US commutes are done in them. Yes, all kind of astonishing, I know.

As a personal anecdote, I always knew cars were costly, but it wasn’t until my dented, rusty, lovable 1999 Silver Honda Civic recently passed away and I compared my before and after monthly spend that I fully grasped this enormous cost reality.

As a wonderful favor, I estimated my spend on transportation 👇 before and after that fateful (or maybe fortuitous?) day.

<if you’re on mobile, turn your screen horizontally for optimal chart readability>

Estimated Cost Differential, Before & After Car

| Category | Before | After | Difference | Comments |

|---|---|---|---|---|

| Car Loan | $0 | $0 | $0 | Car was already paid off |

| Loan Interest | $0 | $0 | $0 | Car was already paid off |

| Gas | $100 | $0 | -$100 | Yikes! $4 per gallon in Los Angeles |

| Maintenance | $50 | $0 | -$50 | Zero chance I can DIY here |

| Insurance | $100 | $0 | -$100 | My parents paid this, but I’m still including it |

| Parking | $50 | $0 | -$50 | |

| Tickets | $25 | $0 | -$25 | |

| Tolls | $5 | $0 | -$5 | More the closer you live to the east coast |

| Other fees | $10 | $0 | -$10 | Lincense & Registration |

| Uber/Lyft & Taxi | $50 | $100 | +$50 | Still had to get to class on time! |

| Bus/Train | $0 | $25 | +$25 | |

| Total | $390 | $125 | $265 | CHA-CHING! |

As you can see, although my spend on alternative forms of transportation increased after the Fateful Day, on “net”—taking everything into consideration—my total transportation category spend fell “secularly”—Wall Street speak for more permanently—by $265 per month. This may not seem like much, but:

(1) If you notice, I had ZERO in car loans. The average car loan payment is $450 per month. I won’t run the numbers again, but I’m sure you get how this would quickly change things.

(2) If we’re more realistic and annualize my $265 per month savings at 8% interest, I end up saving $3,233 per year. In other words, I already have paid for more than an entire year’s worth of daily coffee with 50% still left over for savings…mmmmm!

(3) This doesn’t factor in the non-financial benefits of car non-ownership. Post-car, my monthly lost time in traffic fell by 30 hours, my frustration trying to find parking fell infinitely (to zero), and my contribution to air and NOISE (geez people, easy with the horns) pollution has fallen exponentially.

Ok granted I’ve lived in cities my whole adult life, so I get that totally parting with your car is unrealistic for many of you. Even if you fall into this camp, this list is absolutely still worth a read. One final point, please don’t interpret any of this Post to mean stop going places (aka deprivation, aka squarely incompatible with the The Min-Max Personal Budgeting Technique & Philosophy). Instead, enjoy saving money on transportation while STAYING IN MOTION.

3 Savvy Ways (and one BONUS tip) to Save Money on Transportation

(1) Trade into cheaper transportation modes

This may seem obvious, but the less you drive, the less you’ll spend on transportation, and the less you spend on transportation, the less damage you’ll do to your Eureka Equation (from Budgeting 101). So at every opportunity, actively consider walking, biking, carpooling, taking public transportation, etc. before hopping solo into your personal cash incinerator…er..car…and driving off. I’m sure you’re already aware of this, but as another wonderful favor, I did the “hard math” for you to help prove your intuition. Excluding air, sea, and time (hehe) travel, the cost per mile of various modes of transportation is:

<if you’re on mobile, turn your screen horizontally for optimal chart readability>

Rank | Transport. Mode | Est. Cost/ Mile |

| 1 | Walk | $0 – $0.01 |

| 2 | Bicycle | $0 – $0.05 |

| 3 | Bus | $0.15 – $0.50 |

| 4 | Train | $0.25 – $0.50 |

| 5 | Carpool | $0.40 – $0.60 |

| 6 | Car | $1 – $1.25 |

| 7 | Uber/Lyft, Taxi | $1.50 – $2 |

| 8 | Motor- cycle | $3 – $4 |

As a first action item, I encourage you to print this list and hang it around you car’s rear view mirror…no really, do it! Okay, even if you don’t go to this extreme, seeing here that a car mile is about 4x more costly than a train mile, 20x more than a bike mile, and 100x more than a walk mile, constantly and relentlessly work to “trade up” this list.

For instance, can you carpool to work instead of drive? Can you bus instead of carpool? Can you bike instead of bus? I could go on, but I’m sure you get the point. Not only is taking lower numbers on this list better for your health and the environment, but also it will sustainably increase your Total Amount Saved (again, from Budgeting 101). Who doesn’t love a WIN-WIN-WIN proposition like this? I know Michael does.

(2) Never buy a new car

There are only a few instances of ALWAYS and NEVER in personal finance, but this is absolutely one. According to Kelley Blue Book, the average “new”—manufactured in 2019—car costs $38,000. So, even if you can afford it, please don’t buy one. If it’s still not getting through, if you do nothing else please, please, please don’t buy a new car. Here’s why.

Cars “depreciate”—fall in value—very quickly without losing equivalent performance or reliability. Case in point, once you drive a new car off the lot, it value has just fallen by about 10%. This “deadly mile” has probably just cost you $4,000 and you’ve got nothing but pride (I guess?) in return. Please do me a favor here and chuckle at thy neighbor with a new SUV, don’t envy him/her.

[bctt tweet = “Do me a favor and chuckle at thy neighbor with a new SUV, don’t envy him/her.”]

(3) Keep your car for TWICE as long as your neighbor

Continuing with the neighbor topic, unless your neighbor is an economist, the expected “turnover”—replacement rate—of your neighbor’s car is a brisk 4 years and 8 months. It’s true that cars deteriorate in performance and reliability as they age, but nowhere near this quickly. In all seriousness, this is like sending your parents or grandparents to “a home” in their mid-40s!

I partly blame advertising for this. We are constantly bombarded with car ads, sales, and 0% APR “promotions” by the car industry who *hello* wants to sell us cars. This is a classic business “agency problem”—a situation when it’s not in the best interest of manufacturers to reveal to consumers how long their products actually last. So I’ll reveal here. Assuming standard upkeep, according to leading industry analysts, the average lifespan of a car is at least TWICE the current turnover rate.

$$$ BONUS TIP. Use GasBuddy

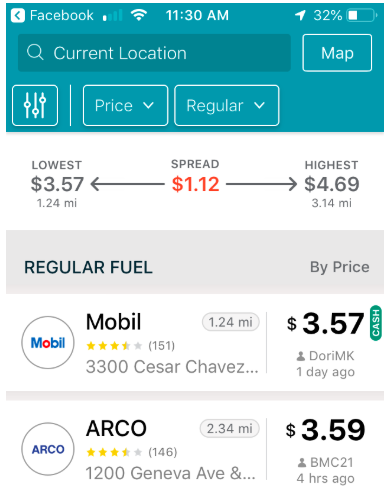

Although I live 20 miles from Silicon Valley, for “evergreen”—marketing speak for timelessness—reasons I try to keep BenFrank Money as tech-agnostic as possible. With that said, this app for Apple’s iOS and Google’s Android is a pure gem (4.7 stars on 284K reviews in the Apple Store). If you’re unfamiliar with GasBuddy or just need a recap, this app gives you a real-time snapshot of all gas station prices in your area, courtesy of fellow GasBuddy users. So nobody falls behind here, we’ll pause for a 30-second download intermission…

- If you’re on iOS mobile, tap here to download

- If you’re on Android mobile, tap here to download

- If you work for GasBuddy, tap here to pay me for this absolutely riveting free ad I’m running for you all

Hehe, okay, back. When you need to fill up, simply fire up this app, then reverse sort by price. If the cheapest available (some stations require membership, such as Costco) station is within a few miles of your location and you have a few extra minutes, it’s absolutely worth spending the additional $3 – $5 to save $15 – $20 on your fill up.

With that said, unless gas for some reason is your maximum expense within transportation, ONLY using GasBuddy from this list would contradict the Min-Max Philosophy (if you’re unsure why, read/skim through The Min-Max Personal Budgeting Technique). Therefore, GasBuddy is just a $$$ BONUS TIP.

As always, if you found this Post educational, motivational, or inspirational, please Share it with your friends & fans on Facebook, LinkedIn, and Twitter! Also as always, if you simply can’t get enough great content, make sure to Join our Newsletter or Book a Call with Yours Truly *NEW FEATURE!*